A trading account is a type of account that is used to buy and sell securities such as stocks, bonds, commodities, currencies, and other financial instruments. A trading account is essential for investors who wish to participate in the stock market or other financial markets. It allows investors to trade securities online or through a broker, and enables them to monitor their investments and make informed decisions.

Opening a trading account is a straightforward process. An investor needs to approach a stockbroker or a financial institution that offers trading services. The investor then needs to fill out an account opening form and submit it along with the required documents such as identity proof, address proof, and PAN card. Once the Online demat account is opened, the investor can start trading securities.

How do Trading Accounts help you?

There are several benefits of having a trading account, let’s take a look at the following:

- Access to financial markets: A trading account allows investors to participate in the stock market, commodity market, currency market, and other financial markets. It offers access to a wide range of securities and financial instruments, which can help investors diversify their portfolios and reduce their risk.

- Convenience: Trading accounts enable investors to buy and sell securities online, which is a convenient and efficient way to trade. Investors can place orders anytime, anywhere, and can monitor their investments in real-time.

- Transparency: Trading accounts offer transparency in trading. Investors can view the price and quantity of securities they are buying or selling and can track the progress of their trades. This helps investors make informed decisions and reduces the risk of fraud or manipulation.

- Flexibility: Trading accounts offer flexibility in share trading. Investors can choose the securities they wish to trade, the quantity they wish to buy or sell, and the time at which they wish to execute their trades. This allows investors to tailor their trading strategy to their individual needs and preferences.

- Lower costs: Trading accounts offer lower costs compared to traditional forms of trading. Investors can save on brokerage fees, transaction fees, and other expenses associated with trading. This can help investors maximize their returns and reduce their costs.

However, it’s imperative to note that trading accounts also come with certain risks. Trading involves the risk of loss, and investors should be aware of the risks before opening a trading account. Investors should also have a clear understanding of the securities they are trading in and should have a well-defined trading strategy in place.

The final thought

In conclusion, a trading account is an essential tool for investors who wish to participate in the stock market or other financial markets. It offers several advantages such as access to financial markets, convenience, transparency, flexibility, and lower costs. Investors should be aware of the risks associated with trading and should have a clear understanding of the securities they are trading and their trading strategy. A trading account can help investors make informed decisions, diversify their portfolios, and maximize their returns. So, how about opening a trading account? Good luck with your investments!

How Long Does It Take to Set Up a Business in the UAE?

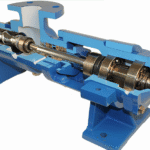

How Long Does It Take to Set Up a Business in the UAE?  Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations

Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations  How to Get Instant Personal Loan Without Income Proof

How to Get Instant Personal Loan Without Income Proof  Difference Between a Savings Account & Current Account

Difference Between a Savings Account & Current Account