As we move into a new year, it’s essential to plan and set financial goals for ourselves. One of the best ways to achieve this is by exploring investment options that provide high returns with low risk. Fixed Deposits (FDs) have long been a popular investment choice for Indian investors as they offer a guaranteed return on investment. Bajaj Finance Digital FDs, in particular, have garnered immense popularity in recent years due to their attractive interest rates, hassle-free online application process, and flexible payout options. In this article, we will explore the new FD offer rolled out by Bajaj Finance in 2023, which is aimed at providing investors with even more benefits and flexibility.

What are Fixed Deposits (FDs)?

FDs are a type of investment in which an individual deposits a lump sum of money with a financial institution for a specified period, typically ranging from 12 to 60 months. In return, the individual receives a fixed rate of interest on their investment, which is predetermined based on the tenure and the financial institution. FDs are considered to be a low-risk investment option as the return on investment (ROI) is guaranteed, and the interest rates are typically higher than those offered by savings accounts.

Why Choose Bajaj Finance Digital FDs?

Bajaj Finance Digital FDs have been a popular choice among investors due to various benefits, including:

– High Credit Rating: Bajaj Finance’s FDs have a CRISIL AAA/Stable rating, which is the highest credit rating given to financial institutions in India. This means that investing in Bajaj Finance Digital FDs provides a high degree of safety and reliability, making it an attractive investment choice.

– Digital Platform: Bajaj Finance’s digital platform allows for hassle-free investments, eliminating the need to visit a branch office. The application process is entirely online, making it convenient and easy to use. Additionally, the digital platform is secure, ensuring that your investment is safe and secure.

– Flexible Investment Tenure: Bajaj Finance offers a range of tenure options, from 12 to 60 months, providing investors with the flexibility to choose the period that best suits their financial needs. Longer-term investments typically offer higher interest rates, making them a lucrative investment option.

– Attractive Interest Rates: Bajaj Finance offers some of the highest interest rates on FDs, with rates up to 8.85% per annum. The rates are only offered on FDs booked digitally, making it a lucrative opportunity for investors who choose to invest through the Bajaj Finserv app or online.

– Different Payout Options: Bajaj Finance provides multiple options for the payout of returns on the investment. Customers can choose between monthly, quarterly, half-yearly, or yearly payout options, depending on their financial needs. This allows investors more flexibility in managing their finances and choosing the options that best suit their requirements.

– Premature Withdrawal and Loan Options: Bajaj Finance allows customers to withdraw their investment prematurely and avail of a loan against their FDs at attractive rates. This option can be accessed in case of an emergency or any unexpected financial requirement. The loan option also allows you to fulfil financial goals such as home renovation, children’s education, or any other major expenses.

– Easy Investment Options: Bajaj Finance Digital FDs require minimal documentation, and the investment process is hassle-free. Investors need to register on the Bajaj Finance website to access the digital FD option. Once registered, investors can choose the investment period, payout options, and payment mode before completing the investment through the Bajaj Finserv app.

Bajaj Finance 2023 FD Offer

Bajaj Finance has recently launched a new FD offer for the year 2023, aimed at providing investors with even more benefits and flexibility. The new FD offer includes:

– Special Interest Rates: Bajaj Finance is offering special interest rates that are higher than the prevailing interest rates on FDs. The rates are applicable for investments made via the Bajaj Finserv app or online.

– Exclusive Benefits: Investors who invest in Bajaj Finance Digital FDs through the app will be eligible for exclusive benefits such as cashback offers, discounts on investments, and other rewards.

– Longer Tenure Options: Bajaj Finance is providing investors with longer tenure options of up to 84 months. This allows investors to earn higher returns on their investments while still maintaining a low-risk profile.

– Higher Maximum Investment Limit: Bajaj Finance is increasing the maximum investment limit to Rs. 10 crore, which is higher than the current limit of Rs. 5 crore. This provides investors with the flexibility to invest larger sums of money and earn higher returns.

– Simplified Application Process: Bajaj Finance has streamlined the digital FD application process, making it even easier and hassle-free for investors to invest in FDs through the app or online.

Investment Apps and the Future of Investing

Investment apps have revolutionized the way people invest in India, providing investors with the convenience of investing from their smartphones. The Bajaj Finserv app is one such app that has made investing in FDs much more accessible and easy to use. With the Bajaj Finserv app, investors can track their investments and access exclusive benefits and rewards such as cashback offers, discounts, and more. Additionally, the app provides investors with a one-stop shop for all their financial requirements, allowing them to manage their investments and finances in one place.

The future of investing in India is undoubtedly digital, with more and more investors opting for digital platforms to manage their investments. Investment apps such as the Bajaj Finserv app are leading the charge, providing investors with a seamless and hassle-free experience. As more investors turn to digital platforms to manage their finances, financial institutions need to continue providing innovative solutions that cater to the evolving needs of investors.

Conclusion

Bajaj Finance Digital FDs have been a popular investment choice among Indian investors, providing a secure and hassle-free investment option with attractive interest rates. With the new FD offer rolled out by Bajaj Finance in 2023, investors can enjoy even more benefits and flexibility, making it an even more attractive investment option. Additionally, investment apps such as the Bajaj Finserv app have made investing in FDs much more accessible and easy to use, providing investors with a one-stop shop for all their financial requirements. As the future of investing in India is undoubtedly digital, financial institutions need to continue providing innovative solutions that cater to the evolving needs of investors.

How an MTF Calculator Makes Margin Trades Clearer

How an MTF Calculator Makes Margin Trades Clearer  Is Shree Ram Twistex IPO a good investment as an upcoming IPO?

Is Shree Ram Twistex IPO a good investment as an upcoming IPO?  How Long Does It Take to Set Up a Business in the UAE?

How Long Does It Take to Set Up a Business in the UAE?  Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations

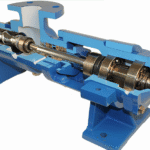

Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations