For a long time, agents mediated the insurance industry in India. Even today, most people hesitate to purchase or renew two-wheeler insurance online. One crucial reason is faith in the old ways of doing things. However, as technology advances, this behaviour is rapidly changing. With more and more businesses moving their operations online, the days of purchasing a bike insurance policy in person are numbered. Indeed, the IRDAI has confirmed an increase in direct digital policies underwritten.

Today, the emergence of smartphones and heavy internet use has made purchasing bike insurance online extremely simple. The online presence of insurance firms, aggregators, and insurance brokers has made it easier for prospective insurance buyers and existing policyholders to renew and buy online two-wheeler insurance policies.

Let us take a look at the benefits of purchasing a bike insurance policy online in detail and depth. Continue reading to learn more.

Benefits of Two-Wheeler Insurance Purchase Online

You’ve probably guessed the main benefits of a two-wheeler insurance purchase online: selecting the right product from the comfort of your own home and paying online. But there are some other benefits as well, and here they are –

Saves Time

All information about the insurance provider and policy, including the cost and coverage amount, is available in one location. It shortens the time it takes to find the best insurance plan. With a single click, you may select the premium and coverage amounts. You may also pay online from anywhere in the nation at any time of the day. It is also simple to do a two-wheeler insurance policy renewal.

Unbiased Recommendation

There are no middlemen when you buy an online two-wheeler policy, so you may filter plans based on your needs. Based on your inputs, you may select from a menu of options suggested by a technology-assisted system. It eliminates any bias that an insurance broker might have. You may make your choice based on clear and straightforward information.

Get the Best Price

Purchasing a bike insurance policy online is far easier when compared to the offline procedure. There are no agents, so you may research and learn about the benefits and premiums for each bike insurance plan at your leisure. Before making the final payment, you may double-check and compare the insurance policy inclusions.

Compare Before Purchasing

One of the most significant advantages of purchasing insurance online is comparing various policies before purchasing one. When comparing policies online, you can look at the incurred claim ratio, the coverage offered, the premium, and so on. Furthermore, such a comparison will allow you to save a significant amount on premiums. You can obtain an online quotation by contacting an insurance broker or aggregator, who will also assist you in selecting the best policy for your insurance needs.

Minimal Documentation

When purchasing two-wheeler insurance online, paperwork plays a minor role. In the majority of cases, there’s no documentation. Only basic details about yourself and the vehicle are required. In some cases, particularly for verification, you may be required to submit documents such as previous insurance policies, personal identification, and so on. You can digitally scan these documents and upload them as needed.

Payment Security

Aside from the benefits mentioned above, purchasing online two-wheeler insurance is entirely secure. You may pay for your bike insurance policy through mobile platforms or internet banking. When the payment is made, you will receive a receipt for the transaction as well as a PDF copy of your insurance plan via email. Most platforms also have a One Time Verification (OTP) method to ensure that your insurance plan is delivered to you only and there is no possibility of policy non-issuance or fraud.

Availability of Add-ons at a Single Click

When you purchase a comprehensive bike insurance policy online, you may add optional add-ons or riders to your plan in seconds. You may also use the online two-wheeler insurance premium calculator to determine the amount of premium you will pay. Coverage for spare parts and accessories, Zero Depreciation cover, Personal Accident coverage, and so on are some of the most popular covers chosen by policyholders. You can purchase these riders for a small fee to increase the level of protection for your two-wheeler.

Things to Keep in Mind when Purchasing Bike Insurance Policy Online

Insurance companies are now trying to explain the meaning of the jargon they use to promote their digital presence. As a result, you will not need any special knowledge to purchase a two-wheeler insurance policy online. However, it is best to follow the following guidelines:

- Make it a point to purchase/renew your policy at least one week before the previous policy’s expiration date.

- Before purchasing a two-wheeler insurance policy, read the terms and conditions.

- Before purchasing, ensure that a reputable insurance company like Tata AIG issues the policy. It will ensure a smooth process when it comes to filing claims.

- Before making the final payment, go through the various social media channels of your preferred two-wheeler insurance provider.

- Read the user testimonials and reviews other customers shared before purchasing the policy.

- Ensure you fully comprehend all the terms and conditions, particularly those pertaining to claim settlement. If you still require clarification, contact the customer support team before purchasing.

Winding Up

With the rapid advancement of technology, purchasing two-wheeler insurance no longer necessitates the assistance of an insurance agent. In fact, with a single click, you can access all of the information you need — coverage, benefits, premium cost, and so on — from various insurers on a single page. Everything from document submission to renewals can now be handled from the comfort of your own home. Although the procedure is straightforward, you must make an informed decision.

You just need to pick a prominent insurance carrier, such as Tata AIG, to purchase a bike insurance plan with all the features in minutes, ensuring mental satisfaction. You can also contact their customer service representative by phone or email for more information.

How Long Does It Take to Set Up a Business in the UAE?

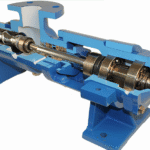

How Long Does It Take to Set Up a Business in the UAE?  Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations

Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations  How to Get Instant Personal Loan Without Income Proof

How to Get Instant Personal Loan Without Income Proof  Difference Between a Savings Account & Current Account

Difference Between a Savings Account & Current Account