The decision of the right type of bank account is important and can be related to how you handle money or even plan for the future. In India, savings accounts and current accounts are the two most common types of bank accounts. While both entail access to your funds, they cater to different financial needs and styles of living.

The familiarity of the features, benefits and intended use of each will also assist you in making a wise decision and have your money work efficiently.

Understanding A Savings Account

The characteristics of a savings account are mainly meant to enable a person to keep the money in a safe way. It promotes the saving habit and is useful in managing everyday expenditures. Some key aspects include:

- Interest Earnings: Savings will typically provide interest on the deposits you have and thus may be used to increase the amount of funds you have over time, even when you frequently withdraw money.

- Transaction Flexibility: You are able to conduct various transactions, including withdrawals, deposits, online transfers, and so it can be used easily on a daily basis.

- Digital Access: The modern savings accounts enable you to check your transactions using mobile applications and online banking websites. This involves real-time notifications on both credits and debits that are used to monitor expenditure and eliminate fraud.

Understanding A Current Account

The current accounts are designed primarily for businesses, professionals and individuals who have a greater number of transactions. They are designed to accommodate high and repetitive financial transactions freely. Here are the key features:

- Unlimited Transactions: A current accounts usually permit unlimited deposits and withdrawals, and is ideal for those dealing with business or frequently high-volume transactions.

- Overdraft Facility: There is a large number of current accounts that offer overdraft facilities, and these allow account holders to access funds in excess of their account balance and up to a specific limit. This assists in meeting urgent cash flow requirements.

- Digital and Business Tools: Many current accounts are now being offered with augmented online banking, including bulk deposits, multiple user access, and simple connection with accounting software to facilitate financial management.

Key Differences Between Savings and Current Accounts

Understanding the differences helps clarify which account is more suitable for your financial needs:

| Feature | Savings Account | Current Account |

| Purpose | Personal savings & daily use | Business & high-volume transactions |

| Interest | Earns interest on deposits | Typically no interest |

| Transaction Limit | Limited free transactions per month | Unlimited transactions |

| Overdraft Facility | Rarely offered | Usually available |

How To Open A Bank Account Online

The process to open bank account online is now easier and quicker than ever. The majority of banks offer a convenient digital process that can be conducted from the comfort of your home. Here is a general step-by-step guide:

- Visit The Bank’s Website or App– Open the official portal of the bank to start the application process.

- Choose The Type– You will need to select either a savings account or a current account, depending on your requirements.

- Submit Personal Details– Enter your name, contact information, and address. Some documents may be required for identity verification.

- Upload Documents– Provide passport and address proof scans or images in accordance with regulatory standards.

- Review and Submit– Carefully check every detail and submit the application. Upon acceptance, you will get the account details and access credentials.

Which Account Should You Choose?

The choice is more or less based on your financial habits and needs. A savings account is the best option if you want to save money on a regular basis, earn interest, and handle personal expenses.

On the other hand, a current account will be better if you are running a business or require cash flow support. By considering your daily financial operations and future requirements, you will be able to choose the best type of account.

Conclusion

Both savings and current accounts play crucial functions in money management. With the knowledge of their features and their alignment with your financial habits, you will be able to make a wise decision.

Open bank account online today, as that allows for quick access to modern banking tools, making money management smoother and more structured than ever.

Is Shree Ram Twistex IPO a good investment as an upcoming IPO?

Is Shree Ram Twistex IPO a good investment as an upcoming IPO?  How Long Does It Take to Set Up a Business in the UAE?

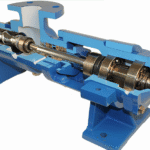

How Long Does It Take to Set Up a Business in the UAE?  Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations

Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations  How to Get Instant Personal Loan Without Income Proof

How to Get Instant Personal Loan Without Income Proof