Travel insurance is a crucial factor for travelers, providing a safety net against unexpected events during international trips. However, throughout the Covid-19 pandemic, travellers have found themselves facing new uncertainties and concerns that were never experienced before.

While you can travel more safely within the country as well as internationally, it can still increase your risk of getting new COVID-19 variants. This has resulted in everyone pondering the same question: Does travel insurance cover Covid-19 cases?

This topic has garnered significant attention and has become a vital aspect to consider when planning travel arrangements. This discussion will delve into the factors influencing travel insurance coverage for Covid-19 cases, highlighting the importance of individuals relying on their insurance policies during these challenging times.

Ensure to proofread the terms and conditions of the travel insurance coverage. Due to broad pandemic exclusions in some plans, losses or expenses brought on by COVID-19 may not be covered. Insurers may have updated their policies to cover specific COVID-19-related costs such as quarantine, medical care, evacuation, trip cancellation, interruption, or extension.*

Stay in touch with your insurer and ask all your pertinent questions for any clarifications if you have any queries about your policy. It’s critical to comprehend the coverage parameters and whether your insurance covers costs associated with COVID-19. Some insurers may only cover medical costs for COVID-19, while others may also cover quarantine costs when a trip is postponed or cancelled due to travel restrictions or quarantine procedures.*

Travel insurance packages cover COVID-19, additional risks like trip cancellation, baggage loss, personal accident, passport and cellphone loss, and flight unforeseen circumstances during trips.*Having a negative COVID-19 report and vaccination certificate is beneficial for travelers, as some insurers may require specific paperwork for claim settlement.

Whether travel insurance in India covers Covid-19 cases has become increasingly relevant and complex in the face of the ongoing global pandemic. While travel insurance providers have adapted their policies to incorporate Covid-19-related coverage, the level of coverage and specific terms can vary greatly between policies and providers.Travelers should carefully review insurance policies, focusing on the fine print and grasping limitations and COVID-19 coverage exclusions.

It is crucial to stay updated on the recent developments in travel regulations, health guidelines, and insurance policies to know what travel insurance covers. Travelers should consider purchasing comprehensive insurance that covers Covid-19-related expenses such as medical treatment, trip cancellations, and disruptions caused by the virus.

A travel insurance premium calculator is a convenient tool you can utilise online to check the coverage needed based on your requirements.

*Standard T&C Apply

Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms, and conditions, please read the sales brochure/policy wording carefully before concluding a sale.

How an MTF Calculator Makes Margin Trades Clearer

How an MTF Calculator Makes Margin Trades Clearer  Is Shree Ram Twistex IPO a good investment as an upcoming IPO?

Is Shree Ram Twistex IPO a good investment as an upcoming IPO?  How Long Does It Take to Set Up a Business in the UAE?

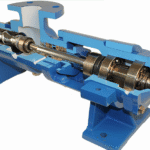

How Long Does It Take to Set Up a Business in the UAE?  Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations

Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations