Stock exchanges are simply market places where commodities, financial securities, derivatives, and diverse other financial instruments are traded. In the past, brokers and traders used to meet physically in a stock exchange building to trade stocks. But now, majority of the financial trading takes place electronically and automatically. Kavan Choksi mentions that every stock exchange has its unique listing requirements for companies that wish to join. Ideally, they require a certain amount of minimal capital, audited earnings, and regular financial reports.

Kavan Choksisheds light on the two key US stock exchanges

Flourishing startups planning to put up an initial public offering (IPO) and companies operating through shareholders must go through a stock exchange. Companies need to swiftly adjust their operations after getting listed. Companies listed on the stock exchange become closely scrutinized and watched entities, as their financials are open for potential investors to go through and analyze. Companies significantly benefit from increased visibility provided by the stock exchange. Being listed helps them to attract new clients, employees, investors, and partners.

The two major U.S. stock exchanges are the New York Stock Exchange and Nasdaq. New York Stock Exchange (NYSE) is popular for being the largest stock exchange in the world based on market capitalization. It was founded way back in 1792. New York Stock Exchange was actually merged with the European Stock Exchange, and was known as Euronext, to form what would be later known as NYSE Euronext in 2007. ICE or Intercontinental Exchange however owns New York Stock Exchange after purchasing the exchange in 2013.

NYSE lists more than 2500 stocks, and includes many of the blue chip companies of the United States. To be listed on this stock exchange, a company must have 1.1 million outstanding shares and 400 shareholders. This exchange is also known as the Big Board as it comprises of one floor for equities while the other is meant for NYSE American options exchange. For a number of years, New York Stock Exchange relied on floor trading that used the open outcry system. However, today, the majority of trades here have transitioned to electronic systems that usually depend on market makers to conduct both automated and physical trading activity. The quotes provided by the market markers tend to be at par with the floor traders and other market participants.

National Association of Securities Dealers Automated Quotations (NASDAQ) is the second largest stock exchange in the world. It was established in the year of 1971, as the very first electronic exchange. It was the first stock exchange to actually use computers to match buyers and sellers. In the year of 2006, this stock exchange separated from the National Association of Securities Dealers and went on to become its own publicly traded company. As per Kavan Choksi today NASDAQ is known to be a leading global electronic marketplace for trading securities. It lists more than 3300 companies, including some of the largest tech companies on the planet. As a wholly electronic exchange, NASDAQ has lower listing fees, relatively modern infrastructure, and proprietary electronic systems.

How an MTF Calculator Makes Margin Trades Clearer

How an MTF Calculator Makes Margin Trades Clearer  Is Shree Ram Twistex IPO a good investment as an upcoming IPO?

Is Shree Ram Twistex IPO a good investment as an upcoming IPO?  How Long Does It Take to Set Up a Business in the UAE?

How Long Does It Take to Set Up a Business in the UAE?  Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations

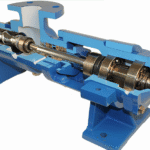

Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations