Introduction

Life insurance is a type of financial product that provides protection for individuals and their loved ones in the event of an unexpected tragedy, in which the individual pays regular premiums to the insurance company in exchange for a guaranteed sum of money to be paid to designated beneficiaries upon the individual’s death. This sum of money, known as the death benefit, can be used for various purposes, such as covering funeral expenses, paying off debt, or providing ongoing financial support for loved ones. Know we know what is life insurance further in this article, we will explore all you need to know about convertible life insurance, including what it is, how it works, and why it may be the perfect choice for you.

What is Convertible Life Insurance?

Convertible life insurance is a type of life insurance policy that allows policyholders to convert their coverage into a different type of policy without undergoing a medical exam or providing evidence of insurability. This means that if your health changes or your insurance needs evolve over time, you can make adjustments to your policy without having to go through the process of applying for a new policy from scratch.

There are two main types of convertible life insurance policies: term life insurance and whole life insurance. Term life insurance provides coverage for a set period of time, usually 10 to 30 years, while whole life insurance provides coverage for the policyholder’s entire life. With a convertible term life insurance policy, you can convert your policy into a whole life insurance policy at any time during the term, while with a convertible whole life insurance policy, you can convert your policy into a different type of policy within the same insurance company.

How Does Convertible Life Insurance Work?

The way convertible life insurance works is relatively simple. When you purchase a convertible life insurance policy, you pay a premium to the insurance company in exchange for coverage. If you decide at any point during the policy term that you want to convert your coverage into a different type of policy, you can do so without having to provide evidence of insurability or undergo a medical exam.

The cost of converting your policy will depend on a variety of factors, including your age, health, and the type of policy you are converting to. However, in most cases, converting your policy will be less expensive than applying for a new policy from scratch, as you will not have to go through the underwriting process again.

Why Choose Convertible Life Insurance?

There are many reasons why someone might choose convertible life insurance over other types of life insurance policies. Some of the key benefits of convertible life insurance include:

Flexibility: Convertible life insurance policies provide policyholders with the flexibility to adjust their coverage as their needs change over time. This can be particularly beneficial for those who are unsure of what their future insurance needs may be.

Cost-effective: Because converting your policy is typically less expensive than applying for a new policy from scratch, convertible life insurance can be a cost-effective option for those who anticipate needing different types of coverage over time.

Peace of mind: With a convertible life insurance policy, you can rest assured that your insurance coverage will be able to adapt to your changing needs, providing you with peace of mind.

FAQs

Is convertible life insurance more expensive than other types of life insurance policies?

The cost of convertible life insurance will depend on a variety of factors, including your age, health, and the type of policy you choose. However, in most cases, convertible life insurance policies are priced competitively with other types of life insurance policies.

How often can I convert my convertible life insurance policy?

The number of times you can convert your convertible life insurance policy will depend on the terms of your specific policy. Some policies may allow for multiple conversions, while others may only allow for one conversion during the policy term. It’s important to review the terms of your policy to understand your options for converting your coverage.

Do I need to provide evidence of insurability to convert my policy?

No, one of the key benefits of convertible life insurance is that you do not need to provide evidence of insurability or undergo a medical exam to convert your coverage. This can make the conversion process much simpler and less stressful.

Can I convert my policy to any type of insurance policy?

No, the types of policies you can convert to will depend on the specific terms of your policy and the offerings of the insurance company. Generally, convertible term life insurance policies can be converted to whole life insurance policies, while convertible whole life insurance policies may allow for conversion to other types of policies within the same insurance company.

Conclusion

Convertible life insurance can be an excellent choice for those who want the flexibility to adjust their insurance coverage as their needs change over time. You can use life insurance premium calculator for finding the premium of particular policy. With a convertible policy, you can rest assured that you will be able to adapt to any changes in your life circumstances without having to go through the process of applying for a new policy from scratch. If you are considering life insurance, be sure to explore all your options and determine whether a convertible policy is the right choice for you. Remember, “Here is all you need to know about convertible life insurance” – it provides flexibility, cost-effectiveness, and peace of mind.

How Long Does It Take to Set Up a Business in the UAE?

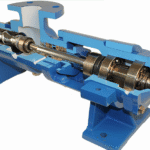

How Long Does It Take to Set Up a Business in the UAE?  Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations

Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations  How to Get Instant Personal Loan Without Income Proof

How to Get Instant Personal Loan Without Income Proof  Difference Between a Savings Account & Current Account

Difference Between a Savings Account & Current Account