Health insurance is a must-have considering the risk-prone environment we live in. Insurance Regulatory and Development Authority of India (IRDAI) aims to secure the life of the policyholders. They bring products that can strengthen health insurance in India and provide the utmost benefits to the customers. One such product they have launched is Saral Suraksha Bima Plan.

What is Saral Suraksha Bima?

The IRDAI has made it mandatory for all general and health insurance companies to offer a standard personal accident insurance policy from the 1st of April 2021. The name of the insurance company will succeed in the policy of Saral Suraksha Bima. Since it is a standard accident product, it will have common coverage and terms across all insurance companies. When you compare health insurance, know that the Saral Suraksha Bima plan will remain the same through all of it. The tenure of the plan is one year and is offered individually. You can visit the official website of IRDAI for further details.

What are the benefits of Saral Suraksha Bima?

With increasing uncertainty, the risk of accidents cannot be ignored. An accident policy is a must-have in your insurance portfolio. Here are the benefits of choosing a Saral Suraksha Bima-

Demise due to accidents

If during your policy, the policyholder loses their life in an accident, a complete 100% sum assured will be paid to the nominee of the policyholder. If the policyholder suffers an injury and eventually loses their lives, they will be paid 100% of the sum assured. This is provided the death occurs within 12 months from the date of the accident.

Partial disability

The Saral Suraksha Bima covers the partial disability of a policyholder. Any suffering caused because of an accident, depending upon the severity, the policyholder will receive a cover of up to 50% of the total sum insured.

Permanent disability

If a policyholder meets with an accident and suffers from total disability, they will receive a cover as per the plan. They will be paid 100% of the sum assured as a benefit given that the disability was caused because of an accident within the policy tenure.

Cost of hospitalisation

During an accident, the policyholder is likely to incur hospitalisation bills. 10% of the base sum assured will be indemnified to cover these hospital bills.

Educational grant

According to the Saral Suraksha Bima, if the policyholder loses their lives because of an accident, their dependent children will be insured. A one-time education grant of 10% of the base sum insured will be provided to the dependent children who are below 25 years of age and are pursuing an educational course.

Being incapable of employment

If a policyholder sustains injury in an accident that makes them incapable of working, the Saral Suraksha Bima plan safeguards them. Since they cannot work anymore because of the injuries of their accident, they will be eligible for compensation at 0.2% of the base sum insured per week until they recover and can resume work again. *

Standard T&C Apply

Use a health insurance premium calculator to know the eligible sum assured and premiums of your Saral Suraksha Bima plan. Insurance is the subject of solicitation. For more details on benefits, exclusions, limitations, terms, and conditions, please read the sales brochure/policy wording carefully before concluding a sale.

How an MTF Calculator Makes Margin Trades Clearer

How an MTF Calculator Makes Margin Trades Clearer  Is Shree Ram Twistex IPO a good investment as an upcoming IPO?

Is Shree Ram Twistex IPO a good investment as an upcoming IPO?  How Long Does It Take to Set Up a Business in the UAE?

How Long Does It Take to Set Up a Business in the UAE?  Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations

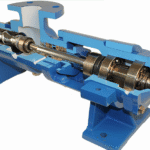

Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations