Earlier, purchasing and renewing car insurance policies or any general insurance policies required phone calls, meeting with the car insurance agent, or personally visiting the insurance company’s office.

Arguably, the most time-consuming aspect of this is gathering a pile of hard copies required for the renewal. Nowadays, doing a car insurance renewal online is a quick and hassle-free process.

Read on to learn the basic five steps for renewing your car insurance online.

- Research on car insurance companies: The first step in purchasing car insurance is to select an insurance company. Ideally, a company that provides excellent pre- and post-sale services should be chosen.

Along with services, the insurer should provide adequate coverage at reasonable prices. Reading online reviews can help you choose an insurer. *

- Determine the type of insurance policy: After deciding on a car insurance company through comparison, go to their website or use their app to check car insurance products. There are two kinds of car insurance policies:

- Third-party car insurance policy: A third-party policy, which covers third-party liabilities, is required by law.

- Comprehensive car insurance policy: A comprehensive policy covers both third-party liabilities and own damage. You can also supplement the coverage with add-ons. *

- Enter your information: After selecting the desired policy type, you will see a simple form where you must fill in your details for car insurance renewal. *

- Choose add-ons: Suppose you have chosen a comprehensive car insurance policy. In that case, you can select add-ons or covers to your policy to broaden the scope of your coverage. Commonly available car insurance add-ons include:

- Zero depreciation: With this add-on, your insurer would not consider your car’s depreciation at the time of claim. Depreciation can sometimes amount to up to 50% of the claim value.

- Roadside assistance: This coverage can save your life if your car breaks down in the middle of the road. This add-on provides services such as towing, minor repairs, fuel, battery jump-start, and so on.

- Return to invoice: If your car is a complete loss due to theft or natural disaster, you can claim the ex-showroom price under this cover.

- Engine protection: If your car’s engine is damaged, you can claim the cost of repairing or replacing it.

- NCB protect: With this add-on, you can make claims while still keeping your No Claim Bonus.

- Consumable Coverage: The cost of replacing consumables in car insurance may be deducted at the time of claim. With a consumable cover, however, this cost is not deducted from the claim amount.

- Personal belongings loss: If an expensive item, such as a mobile or laptop, is stolen from the insured car, you can claim the cost.

* Standard T&C Apply

- Payment: You can make the payment once you’ve decided on the type of policy and add-ons. This completes your process of policy purchase.

When the insurer receives your payment, the company will then email your renewed policy to you. The policy usually comes in PDF format, but you can print it out if you seek to carry a hard copy. You may also ask for a hard copy from the insurance provider. *

* Standard T&C Apply

As you can see, the online car insurance renewal process can be much simpler and faster. Once you get the hang of it, you may never go back to renewing your policies offline. An online car insurance policy is a legally binding document, and clients need not worry about its credibility.

Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms, and conditions, please read the sales brochure/policy wording carefully before concluding a sale.

How an MTF Calculator Makes Margin Trades Clearer

How an MTF Calculator Makes Margin Trades Clearer  Is Shree Ram Twistex IPO a good investment as an upcoming IPO?

Is Shree Ram Twistex IPO a good investment as an upcoming IPO?  How Long Does It Take to Set Up a Business in the UAE?

How Long Does It Take to Set Up a Business in the UAE?  Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations

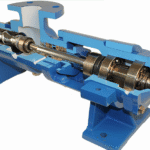

Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations