The scope of personal financing has witnessed a huge leapin India with the introduction of loan apps. Fintech companies have revolutionized the finance industry with its easy to access, simple to avail, instant financing. Once perceived as a high interest debt instrument, today, personal loans have grown to become the most preferred loan in India.

The benefits of a cash loan stretch far beyond their restriction-free use. Some of the best features of these loans are high financing value, flexibility of repayment, easy and quick availability. For instance, when availing a personal loan through a loan app, you can receive approval for the advance within a few minutes of application. But you must fulfil the eligibility and furnish the documentation requirements laid down by your financial institution.

Since a personal loan comes with unrestricted end use, you can avail a cash loan to fulfil any of your financial needs. Below given are some top situations where these cash loans can be beneficial for you.

5 Situations where Personal Loans Can Be Beneficial

1. Medical emergencies

Personal loans can be a great financing option during medical emergencies typically for their ease of availability within a short duration. When facing medical emergencies, one would often require quick financing avenues that allows for easy cash availability in minimum possible time.

A personal loan suits just right in this scenario as these loans come with instant approval and serve as cash loans for immediate financing. With suitable lenders, these loans are easily available within a few minutes only. For a faster and better financing experience, you can always resort to availing these loans from dedicated loan apps.

2. Financing higher education peripherals

Financing higher education requires much more than just paying the tuition fees. For instance, one may need to pay for travel tickets, accommodation fees, cost of food, and other miscellaneous costs. You can easily avail financing up to Rs.1.5 lakh as a personal loan through these dedicated loan apps.

Though there are education loans, availing an education loan is often a complex process. It demands collateral, admission in reputed college and lengthy paperwork. If the requirement is not that high, then a cash loan through a loan app can be your best bet.

3. Home renovation

Another purpose where personal loans are most suitably used is in home renovation. When utilising the advance for renovating their home, a borrower gets benefits that extend way beyond the upliftment of their house. You can use a personal loan for interiors, repair work, furniture, wall painting and much more.

You do not need to put up your property as collateral while availing a personal loan. This loan is extended based on your salary and repayment capability. However, you must have a proper repayment plan in place before availing a personal loan for home renovation. You should also reconsider your budget and keep the loan amount as low as possible.

4. Debt consolidation

Another financing avenue that derives the most benefits through personal loans and is widely utilised is debt consolidation. As big-ticket loans with zero end-use restrictions, these advances serve just right in consolidating multiple small debts into one. Finding a loan that attracts low rates of interest on an average as against the multiple advances serviced also brings better affordability. Not to mention, servicing one loan only instead of multiple loans also saves one valuable time and effort.

5. Meeting travel expenses

A personal loan can be your best choice when it comes to planning your travel budget. From booking travel tickets to paying for accommodation and other activities, a personal loan suits just right to fulfil all travel related expenditures that one may require.

You can apply for an instant personal loan through a loan app, from anywhere and anytime.If you fulfil the eligibility requirements then the loan amount will get disbursed in your account within 24 to 48 hours.

Conclusion

While these are some top reasons to avail a personal loan, you can consider a personal loan to fulfil your other financial needs as well. For instance, in cases where one needs additional financing to infuse in their business, cash loans can come handy. With zero restrictions to end use, these loans can be used to meet any kind of cash needs.

Further, you may also resort to availing a personal loan for the purpose of improving your credit history. As unsecured advances, these loans extend just the right opportunity for building your credit history based on your repayment habits. You can manage timely payment of EMIs and complete total repayment on time to build a positive impact on your credit history.

In conclusion, your reason for availing a personal loan may vary depending on your financial situation. However, one thing you must remember is that a personal loan is a big financial commitment and you must do your thorough research and planning before availing this finance.

How an MTF Calculator Makes Margin Trades Clearer

How an MTF Calculator Makes Margin Trades Clearer  Is Shree Ram Twistex IPO a good investment as an upcoming IPO?

Is Shree Ram Twistex IPO a good investment as an upcoming IPO?  How Long Does It Take to Set Up a Business in the UAE?

How Long Does It Take to Set Up a Business in the UAE?  Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations

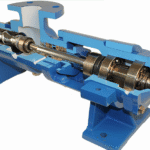

Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations