Equity Linked Saving Schemes (ELSS) are popular tax-saving investment options that not only offer attractive returns but also help investors save on taxes under Section 80C. With a multitude of ELSS funds available in the market, it can be challenging to decide which one to invest in and how to optimize your investments. Read on to delve into smart strategies for selecting the right ELSS funds, maximizing returns through systematic investments, and efficiently managing your tax-saving investments to ultimately build wealth for your financial goals.

Choose your fund wisely

There are many ELSS funds to choose from. Look at the fund’s investment objective and strategy to determine if it suits your risk appetite. Check the fund’s past performance over 3 to 5 years to see if it has consistently beaten its benchmark. Consider the fund manager’s experience and track record as well. Some top ELSS funds are Axis Long Term Equity Fund, Kotak Tax Saver, and Tata India Tax Savings Fund.

Start early through SIPs

An excellent way to invest in ELSS is through a Systematic Investment Plan or SIP. With an SIP, you invest a fixed amount regularly in an ELSS fund to take advantage of rupee cost averaging. Starting an SIP early in ELSS funds helps you benefit from the power of compounding. Your money grows faster as the investment tenure increases. You can start an SIP with as little as Rs. 100 per month.

Increase your SIP amount

As your income rises each year, increase your ELSS SIP amount. This will ensure you maximize your 80C tax benefit and save more tax. Even increasing your SIP amount marginally by 10-15% each year can make a big difference in the long run due to the compounding effect. You can also invest any annual windfalls or bonuses in your ELSS SIP to give it a boost.

Invest near the year-end

Many people invest in ELSS at the end of the financial year to claim the 80C tax benefit for that year. While investing late is better than not investing at all, investing through the year via SIP is a superior approach. However, if you have to choose, investing in the last few months of the fiscal year, i.e. January to March, can still help you save tax for that year and benefit from any end-of-year fund inflows.

Consider a lumpsum investment

If you have a large amount to invest at one go, consider making a lump sum investment in ELSS funds. A lump sum investment of Rs. 1-2 lakhs in top performing ELSS funds has the potential to generate substantial tax-free returns over the long run. You can invest lump sums each year along with starting an SIP to maximize tax savings and returns through equity exposure.

Conclusion

With smart strategies like choosing the right fund, starting an SIP early, increasing SIP amounts regularly, end-of-year investing and lump sum investments, you can optimally benefit from investing in ELSS funds. An intelligent combination of these strategies can help you save a lot of tax and build wealth for your important life goals.

How an MTF Calculator Makes Margin Trades Clearer

How an MTF Calculator Makes Margin Trades Clearer  Is Shree Ram Twistex IPO a good investment as an upcoming IPO?

Is Shree Ram Twistex IPO a good investment as an upcoming IPO?  How Long Does It Take to Set Up a Business in the UAE?

How Long Does It Take to Set Up a Business in the UAE?  Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations

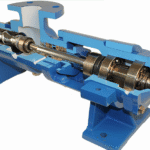

Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations