In the bustling landscape of Indian roads, the desire for personal vehicles has significantly surged. Whether you’re navigating the chaos of city traffic or planning a peaceful weekend getaway, owning a car or a motorcycle presents unparalleled convenience. However, financing these purchases involves understanding the nuances of car loans and motorcycle loans. Though they might seem similar at first glance, loan terms can vary quite a bit between them. This article delves into these differences, providing you with a roadmap to make informed decisions.

Understanding Car Loans and Motorcycle Loans

Before diving into the specifics, it’s essential to understand what constitutes a car loan versus a motorcycle loan. A car loan is a sum borrowed specifically for purchasing a car, while a motorcycle loan is tailored for buying a two-wheeler. Both these loans are secured against the vehicle, meaning failure to repay allows the lender to seize the vehicle.

However, the difference lies in various terms and conditions, including interest rates, repayment tenures, and eligibility criteria, all of which can significantly influence your financial planning.

Interest Rates: A Major Differentiator

Car Loan Interest Rates

Interest rates for car loans tend to be lower than those for motorcycle loans. This can primarily be attributed to the loan amount involved. Cars are usually more expensive than motorcycles, leading to larger loan amounts and a competitive market among lenders to attract potential car buyers. According to recent data, the average interest rate for a new car loan in India hovers around 7.5% to 9%.

Motorcycle Loan Interest Rates

In contrast, motorcycle loans generally feature higher interest rates, ranging from 9% to 15%. Since motorcycles are priced significantly lower than cars, lenders compensate for the smaller loan amounts by charging a higher rate. Despite this, motorcycles are an attractive choice for many due to their affordability, especially among first-time buyers and young professionals.

Loan Tenure: Short vs Long Commitment

Typical Car Loan Tenure

Car loans typically offer longer repayment tenures, often stretching up to 7 years. This extended period allows borrowers to opt for lower EMIs, making it easier to integrate the monthly payments into their budgets. However, a longer tenure means paying more in interest over time, a factor worth considering if you’re looking at the total financial impact.

Typical Motorcycle Loan Tenure

Motorcycle loans, on the other hand, usually come with shorter tenures, typically maxing out at 3 to 4 years. The brevity of these loans is due to the relatively lower loan amounts. While the higher monthly EMIs might seem daunting, the reduced interest paid over the loan’s lifetime can be financially beneficial.

Down Payments: An Upfront Investment

Most lenders require an upfront payment, known as a down payment, for both car and motorcycle loans. However, the amount and percentage difference between these loans can be substantial.

Car Loan Down Payments

For car loans, lenders typically expect a down payment of about 15% to 20% of the car’s on-road price. Making a larger down payment can reduce the loan amount and lower your monthly EMIs.

Motorcycle Loan Down Payments

Motorcycle loans often require a down payment ranging from 10% to 15%. Due to the lower vehicle cost, this upfront investment is relatively smaller, making it more accessible for buyers who may not have significant savings.

Documentation and Eligibility: Navigating the Paperwork

When it comes to documentation, the processes for car loans and motorcycle loans are somewhat similar but not identical.

Applying for a Car Loan

To secure a car loan, lenders typically require extensive documentation, including proof of identity, address, income, and sometimes even prior credit history. The eligibility for a car loan in India often hinges on a stable income and an assurance of repayment capability.

Applying for a Motorcycle Loan

While the documentation for a motorcycle loan can be less exhaustive, lenders still require proof of identity, address, and income. The eligibility criteria may be more lenient, making it easier for individuals such as students or part-time workers to access a motorcycle loan.

The Impact of Credit Score: A Universal Consideration

Regardless of whether you’re eyeing a car or a motorcycle, your credit score plays a pivotal role in determining the interest rate and loan amount. A higher credit score can lead to more favourable terms, such as lower interest rates and reduced EMIs.

Improving Your Credit Score

If your credit score is less than ideal, consider taking steps to improve it before applying for a loan. Simple measures such as timely payment of existing debts and maintaining a low credit utilisation ratio can make a substantial difference.

Hidden Costs: Look Before You Leap

When considering a loan, it’s essential to be aware of potential hidden costs, including processing fees, late payment charges, and prepayment penalties. Car loans might also include insurance and maintenance packages that could inflate the overall cost. Similarly, motorcycle loans can have added costs for accessories and gear.

Conclusion: Making an Informed Choice

In the grand scheme of things, choosing between a car loan and a motorcycle loan should align with your financial goals and lifestyle needs. Each type of loan offers unique benefits and challenges that must be carefully weighed. Consider your financial situation, future plans, and the intended use of the vehicle when making your decision.

For many, a car represents comfort and space, suitable for families and long-distance travel. Meanwhile, a motorcycle often symbolises agility and efficiency, ideal for navigating crowded urban environments. By understanding the nuances of these loan types, you can make a decision that fuels the road ahead—financially and experientially.

As you steer through the process, remember the value of diligent research and consultation with financial advisors. After all, securing the right loan isn’t just about affording a vehicle; it’s about enhancing your journey in the most economical and efficient way possible.

In the end, whether it’s the freedom of the open road on two wheels or the comfort of four seats, the right choice in loans ensures that your ride, and the ride of life, is as smooth as possible.

How an MTF Calculator Makes Margin Trades Clearer

How an MTF Calculator Makes Margin Trades Clearer  Is Shree Ram Twistex IPO a good investment as an upcoming IPO?

Is Shree Ram Twistex IPO a good investment as an upcoming IPO?  How Long Does It Take to Set Up a Business in the UAE?

How Long Does It Take to Set Up a Business in the UAE?  Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations

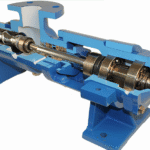

Why Progressive Cavity Pumps Play a Critical Role in Modern Industrial Operations